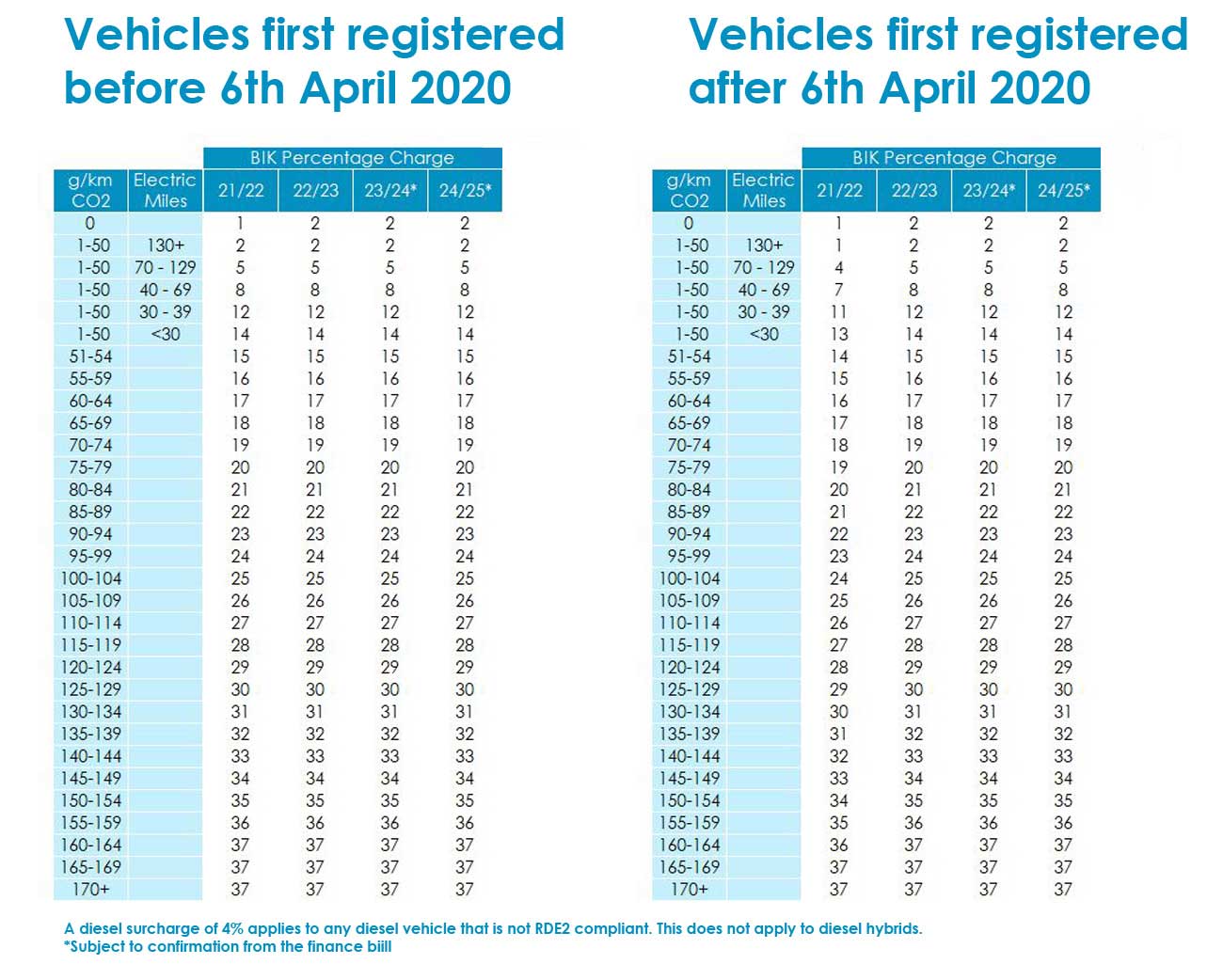

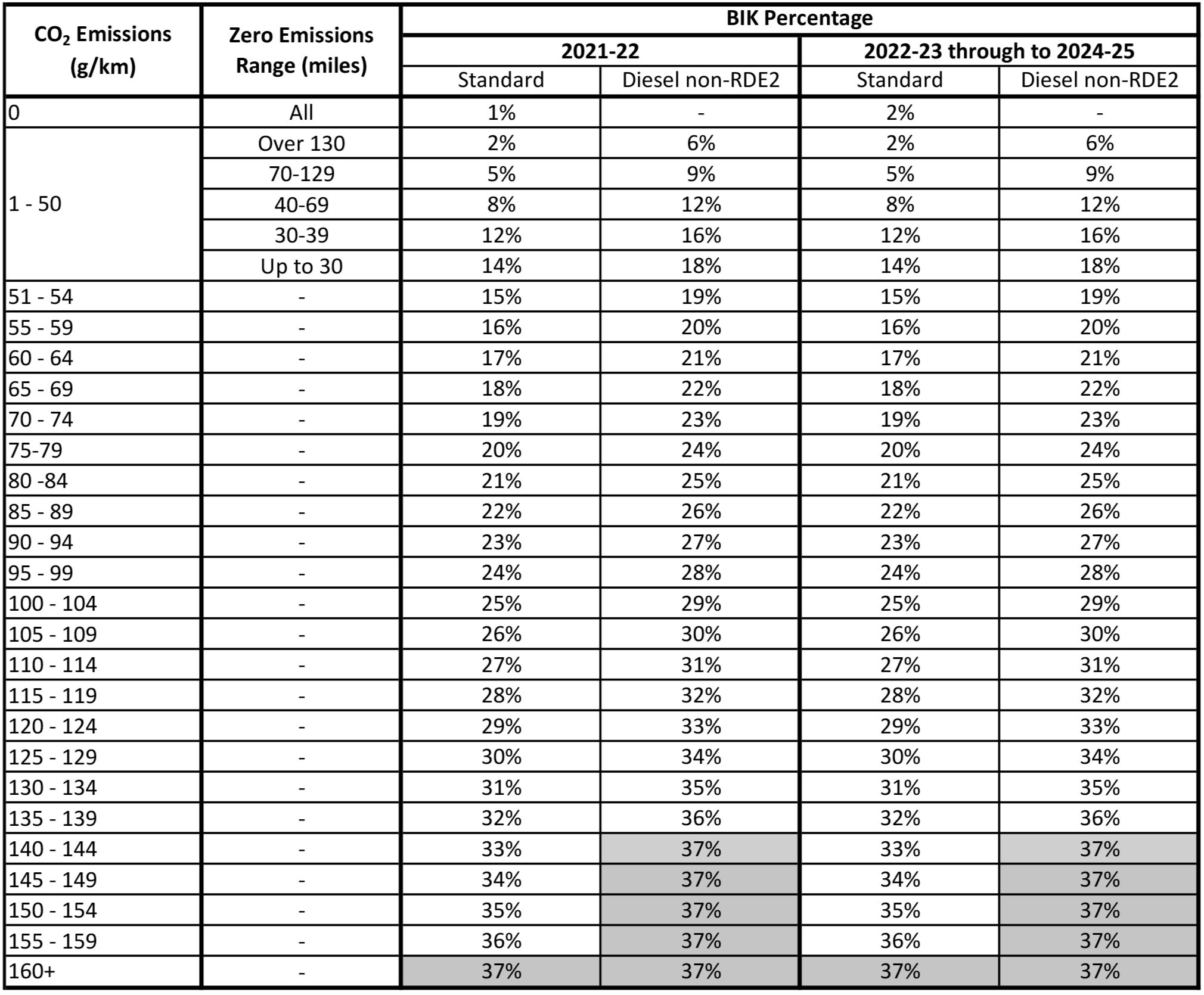

Company Car Tax Changes 2025 New York. Everything you need to know company car tax is worked out using a vehicle’s emissions, its value, and your salary; Personal use of a company.

This is how the formula. Under irs general rules, all use of a company car is considered personal use unless the employee documents the business use of the car.

Doublecab pickup truck tax explained 2025 company car tax changes, These changes will increase the corporation tax rate to.

Company car tax changes sees uptake of electric vehicles Powersystems, Potential changes in new york state tax rates.

Carolina Herrera Ready To Wear Spring Summer 2025 New York NOWFASHION, New car tax rules have been confirmed by the treasury which are set to come in next spring, which could see motorists have to make changes.

Doublecab pickup truck tax explained 2025 company car tax changes, Drivers have been warned they only have a few months to prepare for the upcoming car tax changes announced by chancellor rachel reeves during the autumn.

New Car Tax Rates 2025 Jaine Phylis, Changes to company car tax will come into force from 6 april 2025, 2026, and 2027, respectively, and are due if an employer provides an employee with a company car that is available for private use.

New Car Tax Rates 2025/2025 Ivett Letisha, The changes in the appropriate percentage for company cars for the tax year 2028 to 2029 through to the tax year 2029 to 2030 were announced at autumn budget 2025.

Hmrc Tax Allowances 2025 2025 Image to u, Changes to company car tax will come into force from 6 april 2025, 2026, and 2027, respectively, and are due if an employer provides an employee with a company car that is available for private use.

Getting Ready With Carmelo Anthony for Armani Spring 2025 New, From april 2025, these vehicles.

New Car Tax Bands Uk 2025 Joni Bobbette, Everything you need to know company car tax is worked out using a vehicle’s emissions, its value, and your salary;